san francisco gross receipts tax instructions

The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. Taxpayers deriving gross receipts from business activities both within and outside San Francisco must generally allocate andor apportion gross receipts to San Francisco using rules set forth in.

Key Dates Deadlines Sf Business Portal

City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

. The last four 4 digits of your Tax Identification Number. For entities and combined groups with San Francisco-sourced gross annual receipts of over 50 million the Homelessness Gross Receipts Tax imposes an additional rate ranging from 0175 to 0690 depending on the line of business. The HUDOC database provides access to the case-law of the Court Grand Chamber Chamber and Committee judgments and decisions communicated cases advisory opinions and legal summaries from the Case-Law Information Note the European Commission of Human Rights decisions and.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component and an increasing gross receipts tax. To avoid late penaltiesfees the returns must be submitted and paid o n or before February 28 2022. Obligation Summary Calculation of Fees Line A - 2021 Taxable San Francisco Gross Receipts.

Tuesday June 7 2022. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. B The gross receipts tax is a privilege tax imposed upon persons engaging in business within the City for the privilege of engaging in a business or occupation in the City. Gross Receipts Tax Applicable to Private Education and Health Services.

Gross receipts shall not include any amount of third-party taxes that a taxpayer collects from or on behalf of the taxpayers customers and remits to the appropriate governmental entity imposing such tax. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. To begin filing your 2020 Annual Business Tax Returns please enter.

Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. 2 For the business activity selected enter the sum of all excludable taxes in. The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City.

You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments toward 2020 San Francisco taxes as you may be eligible for a refund. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. San Francisco Tax Collector PO.

Administrative and Support Services. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. SAN FRANCISCO RESIDENTIAL RENT ASSISTANCE PROGRAM FOR PERSONS DISQUALIFIED FROM FEDERAL RENT SUBSIDY PROGRAMS BY THE FEDERAL QUALITY HOUSING AND WORK RESPONSIBILITY ACT OF 1998 QHWRA.

Watch our instructional videos on filing your. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of. San francisco gross receipts tax instructions.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross Receipts Tax. File Annual Business Tax Returns 2021 Instructions. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

Gross receipts shall not include any tax refunds received by a person from a governmental entity. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. The Homelessness Gross Receipts Tax is applied to combined San Francisco taxable gross receipts above 50000000The small business exemption threshold for the Commercial Rents Tax is 2000000 in combined San Francisco gross receipts from all.

The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012. We will contact you with instructions if the exemption is denied. Include only the payment stub with your payment.

The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. Displays the gross receipts that was entered on the previous screen.

The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Your seven 7 digit Business Account Number.

A persons liability for the gross receipts tax shall be calculated according to Sections 9531 through 9537. For a detailed discussion of this tax access PwCs prior Insight here. Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways.

If eligible based on your filing your refund will be processed automatically.

Calfresh San Francisco 2022 Guide California Food Stamps Help

Gross Receipts Tax Return 2019 Youtube

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Safe Harbor Cpa Accounting Firm Business International Corporate In San Francisco California

Homelessness Gross Receipts Tax

Treasurer Jose Cisneros Facebook

Annual Business Tax Returns 2021 Treasurer Tax Collector

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Homelessness Gross Receipts Tax

San Francisco Gross Receipts Tax

California San Francisco Business Tax Overhaul Measure Kpmg United States

Sf Business Portal Sf Business Portal

These Are San Francisco S Highest Paid City Employees In 2018 San Francisco Business Times

San Francisco Taxes Filings Due February 28 2022 Pwc

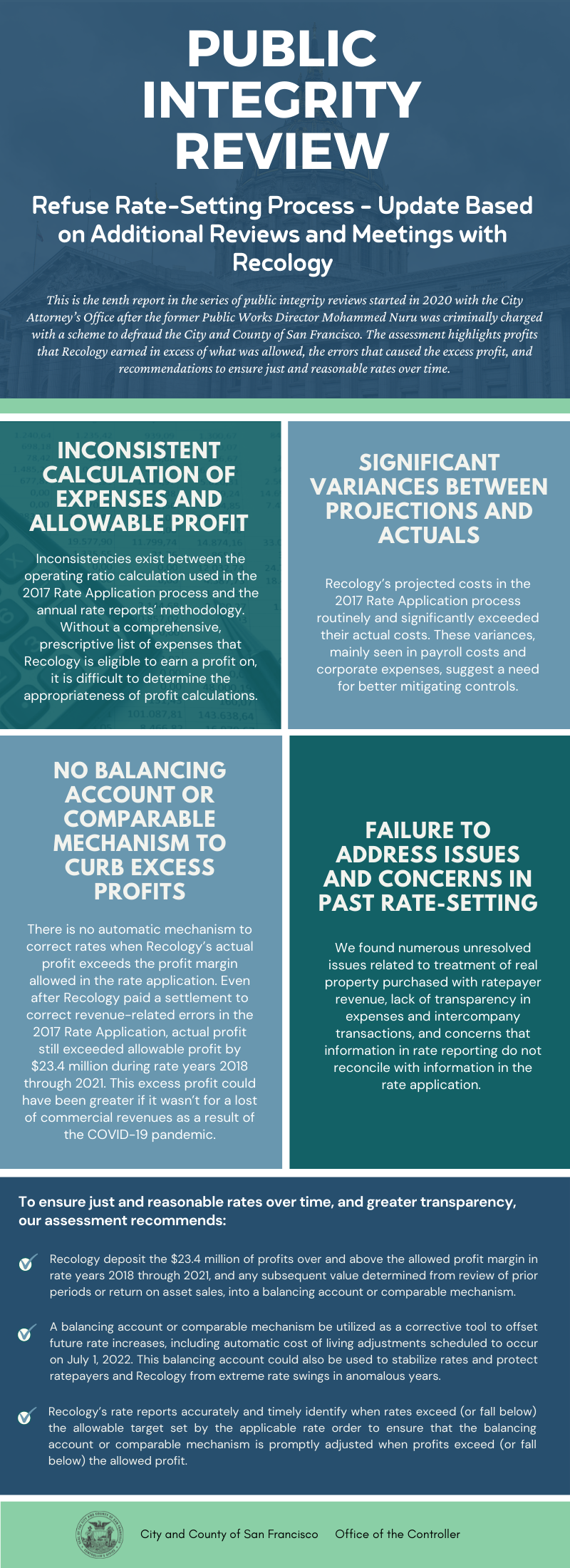

Findings Released On The Refuse Rate Setting And Rate Reporting Processes And Profits Earned By Recology Over And Above Allowed Profit Margins Office Of The Controller